By Gustavo García López*

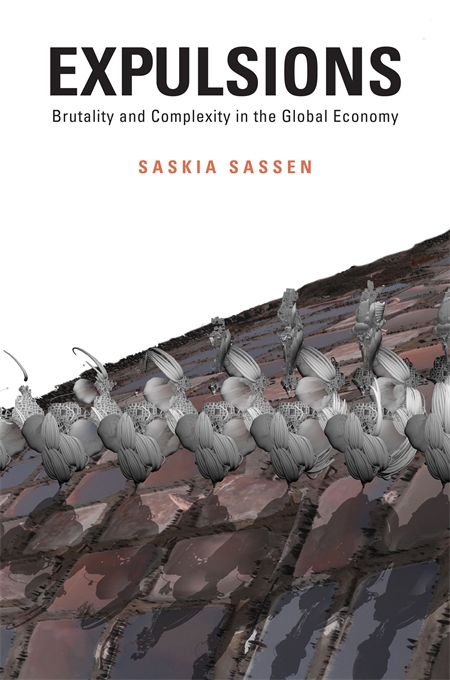

Saskia Sassen (Professor of Sociology, Columbia University) argues that the foundational transformation of capitalism since the 1980s is dominated by a speculative and extractive logic, characterized by “predatory formations” such as vulture funds making cities of ‘dead buildings’ and peripheries of expelled people.

In her recent keynote speech at the 16th Biennial Conference of the International Association for the Study of the Commons in Utrecht, Netherlands, Saskia Sassen offered a keynote speech on the “Extractive logics in our economy: geographies of expulsion” (see the video here).

Sassen offering her keynote lecture at the IASC conference, July 11, 2017. Source: IASC

In her recent paper, “Predatory formations dressed in Wall Street suits and algorithmic math”, Sassen has described these formations as systemic in character and based on “assemblages” of complex core elements of knowledge and technologies from key domains and capabilities of our societies. These include algorithmic mathematics, law and accounting, and high-level logistics. Such assemblages install themselves within the physical and institutional infrastructure of nation-states, having a single purpose: the extraction of a maximum profit, as quickly as possible. This, in turn, dramatically changes territories and lives, as dramatized by Sassen’s examples of the complete disappearance of the Aral Sea –one of the biggest internal seas in the world– in two decades (1989-2009), and the drastic reduction in Greenland’s ice sheet.

Sassen’s 2014 book Expulsions. Source: Harvard University Press.

A second type of operation discussed by Sassen is that of “vulture funds” –a type of hedge fund which speculates with debts considered to be distressed or in danger of default (amounting to a bet that the debtor will default)– which she further analyzes in “The Vultures of Wall Street”. Sassen showed how funds have been acquiring huge amounts of the debt of countries across the world, and receiving dramatically increasing returns on these ‘investments’. She provided the dramatic example of Elliot Management, owned by billionaire Paul Singer, which has made “wild” profits on multiples countries’ sovereign debt: $35.5 million in Panama, $46.6 million in Peru, $70 million in Congo, and potentially more than $2 billion on Argentina’s debt (pending). Hedge Clipper further reported that Elliot Management is expecting an estimated 1380% return on its initial investment.

Protest in New York against vulture fund operations in Argentina. Source: Telesur TV

Sassen made clear that this is not about developing housing for current needs, but rather about investing in owning land for speculative purposes. As a result, many of the buildings being bought are empty. In the Bloomberg Tower in New York, for instance, 57% of condos are owned by ‘shell’ companies and currently do not have residents. These “global cities” are produced by and for global corporations (particularly in the financial sector), which despite being highly digitized, need ‘central places’ –perhaps more than ever before– where they can access a whole set of complex specialized services. These cities are thus increasingly marked by the production of extremes: a city center ‘densely urbanized’ but filled with “dead” corporate buildings, and an expanding periphery of those expelled from the center in the name of “upgrading” “modernization”. Sassen noted the similar processes occurring in rural areas, where “land grabbing” kills land and people for mining, large-scale agricultural plantations, dams, and other development plans.

Urban expulsions, or l’ere de la brutalité. Source: Télérama magazine

What to do to counter these extractivist, predatory processes? Sassen concluded by arguing that the potential to do so lies in the struggles of the expelled at the frontiers of urban areas, the sites of encounter of actors from different worlds where there are no established rules. It is the space where those without power get to “remake history”, where marginal people that have been invisibilized remind us that they are present: “estamos presentes”. Thus, argued Sassen, we should strive to keep alive these frontiers, these flexible spaces in cities, where people can make and remake their own economies, relations, lives.

Platform for Mortgage-Affected People (PAH) occupy the streets in protest against against evictions and for the right to housing. Source: PAH

* Gustavo García López is an Assistant Professor in Environmental Planning at the Graduate School of Planning, University of Puerto Rico – Rio Piedras and a member of the ENTITLE collective. He works on the politics of collective action in commons and environmental movements.

an updated version of the N. Klein’s message in The Shock Doctrine…a call for wise development of political assembly is crucial. very glad to hear the mention of puerto rico as it seems to me a *textbook case study* of what predatory formations are capable of.

don’t forget Detroit…

https://theintercept.com/2017/08/09/atlas-network-alejandro-chafuen-libertarian-think-tank-latin-america-brazil/

detroit, certainly…but not nearly for so long as PR and not so overtly; *clearly unjust colonial abuse* by a ‘democratic’ nation state. thanks for the excellent link.

indeed, but then Detroit as an internal/domesticated territory is supposed to have protections not afforded to a colony, and yet…

https://archpaper.com/2017/08/saskia-sassen-hack-global-cities/

Reblogged this on Deterritorial Investigations .